Amazon is expected to occupy nearly 98 million square feet across the U.S. in 2020 alone

A key measure of demand for big warehouses soared 51% in the first half of 2020 as the pandemic-driven surge in online sales sent companies scrambling for space to store and deliver goods to locked-down consumers.

The rush toward distribution centers was most pronounced at the largest end of the market, real-estate brokerage firm Colliers International Group Inc. said in a report released Thursday, as Amazon. com Inc. and other e-commerce and logistics providers accelerated a push toward sprawling facilities to process, package and ship digital orders.

The report covers industrial buildings of 200,000 square feet or more in major North American markets.

“There is a surge in big-box occupancy,” said Pete Quinn, the firm’s national director of industrial services. “Amazon obviously leads the pack. They’ve got multiple big boxes going up all over the country.”

The online behemoth leased an estimated 26.9 million square feet in the first half of the year, and is expected to occupy nearly 98 million square feet across the U.S. in 2020 alone, the report said.

Overall, the Colliers report said the net change in occupied big-box space—known as net absorption—rose by 51% in the first half of this year in the markets covered from the same period in 2019, to nearly 79.8 million square feet.

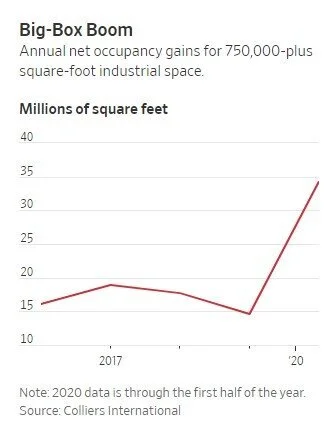

For sites of 750,000 square feet or more, net absorption came to 34.3 million square feet in the first six months of the year, more than double the amount recorded for all of 2019, Colliers said.

Amazon has been racing to meet surging online demand after a wave of orders from homebound shoppers slowed deliveries in the early months of the pandemic. The company said recently it was opening 100 buildings in September alone, including fulfillment centers, delivery stations, sorting centers and other sites.

An Amazon spokeswoman declined to comment on the Colliers report but pointed to comments by Chief Financial Officer Brian Olsavsky in a July 30 earnings call, when he said Amazon plans to expand its fulfillment and logistics square footage by about 50% in 2020 from the previous year. Most of that capacity was expected “to come online in late Q3 and Q4,” he said.

E-commerce sales accounted for a record 16.1% of total U.S. retail sales in the second quarter on an adjusted basis, according to the Commerce Department. Online sales rose 31.8% from the first quarter, and jumped 44.5% year-over-year.

For industrial real estate, the rapid expansion of digital commerce appears to be offsetting slowdowns and bankruptcies in sectors such as traditional retail, Mr. Quinn said.

Companies are also looking for more space as they move away from lean just-in-time inventory practices following shortages early in the pandemic, when stockpiling shoppers emptied shelves and manufacturers struggled to ramp up production of in-demand goods such as toilet paper.

“Right now we’re guessing companies are increasing safety stock by about 5% to 15%,” boosting their need for warehouse space, Mr. Quinn said. “We don’t see a lot of companies downsizing their distribution.”

Competition for warehouse space is especially high in logistics hubs such as Southern California’s Inland Empire, Atlanta and the Dallas-Fort Worth area in Texas with large pools of skilled labor and access to key transportation routes. For example in Indianapolis, where several big projects are being built, tenants are locking in leases before the buildings are finished, Mr. Quinn said.

Developers are hustling to meet that demand. Some 96.5 million square feet of new big-box space was added in the first half of 2020, the report found, and an additional 170.7 million square feet was under construction at the end of the second quarter.