44% Of Global eCommerce Is Owned By 4 Chinese Companies

Just a few e-commerce marketplace giants control the $3.4 trillion global e-commerce space.

58% of global e-commerce is concentrated in just six companies. And just four Chinese companies account for almost half of global digital sales.

Global e-commerce reached $3.4 trillion last year, according to a new report from Activate Consulting. Thousands of brands and retailers divvy up just 37% share of that, while six giants who are mostly Chinese companies vacuum up more than half of the pie. One key reason: retail in China is simply much more digital than it is in Europe or North America.

The biggest digital commerce companies, with the percentage of the global e-commerce market that they own:

Taobao.com: 1TMall.com: 14%

Amazon: 13%

JD.com: 9%

Pinduoduo: 4%

eBay: 3%

Interestingly, most of that revenue is recognized via marketplace sales. In other words, this is not traditional retail where a company stocks a product, sells it, and gives (or ships) it to a customer. Rather, they are marketplaces that connect buyers and sellers, enabling transactions between buyers and sellers for products that the retailers may never physically touch, or if they do, may never actually own.

About 5% of the global e-commerce share is taken up by a small group of still-massive companies:

Rakuten

Walmart

VIP.com

Sunning.com

Apple

Shopee

As we’ve seen previously, the Covid-19 pandemic accelerated growth far faster than previously forecast. Average digital commerce growth in the U.S. over the past few years has been in the 15% per year range, with slowing growth predicted for the future as the total volume continues to grow.

But this year, e-commerce retail sales more than doubled, seeing 32% growth so far, far more than 2019’s 15%.

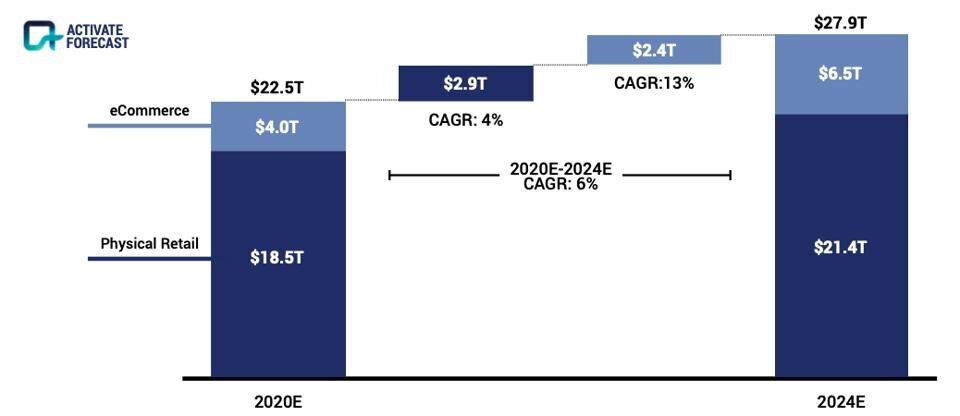

E-commerce growth has been huge in 2020, and will continue to grow in the future

That growth will continue.

E-commerce is forecast to almost double by 2024, growing to $6.5 trillion globally from last year’s $3.4 trillion. Interestingly, while e-commerce will outpace physical retail in growth rate, physical retail will also grow, and will still dwarf e-commerce and m-commerce.

Activate estimates that physical retail will do $18.5 trillion in sales in 2020, and will hit $21.4 trillion in 2024. Digital commerce’s share of total retail sales will be 18% this year, and 23% in 2024, according to the company’s forecasts.

Global retail sales by physical retail and e-commerce.

Driving that growth: about a quarter of people who had never bought via digital commerce methods on computer, tablet, or smartphone before in key areas like clothing, shoes, household products, and personal care. And a whopping 43% who bought groceries online for the first time ever, thanks to the pandemic.