What is the right strategy for micro-fulfillment?

The rise of micro-fulfillment centers (MFCs) in recent years has emerged to help retailers address escalating omnichannel fulfillment challenges. This is especially true in the grocery segment, where pandemic-related concerns rapidly accelerated the growth of in-store, e-commerce business models such as click-and-collect and direct-to-consumer delivery. Regardless of the market sector, MFC strategies allow retailers to locate their fulfillment operations closer to their customers to improve last-mile and last-hour delivery logistics — in many cases, by leveraging their existing store networks.

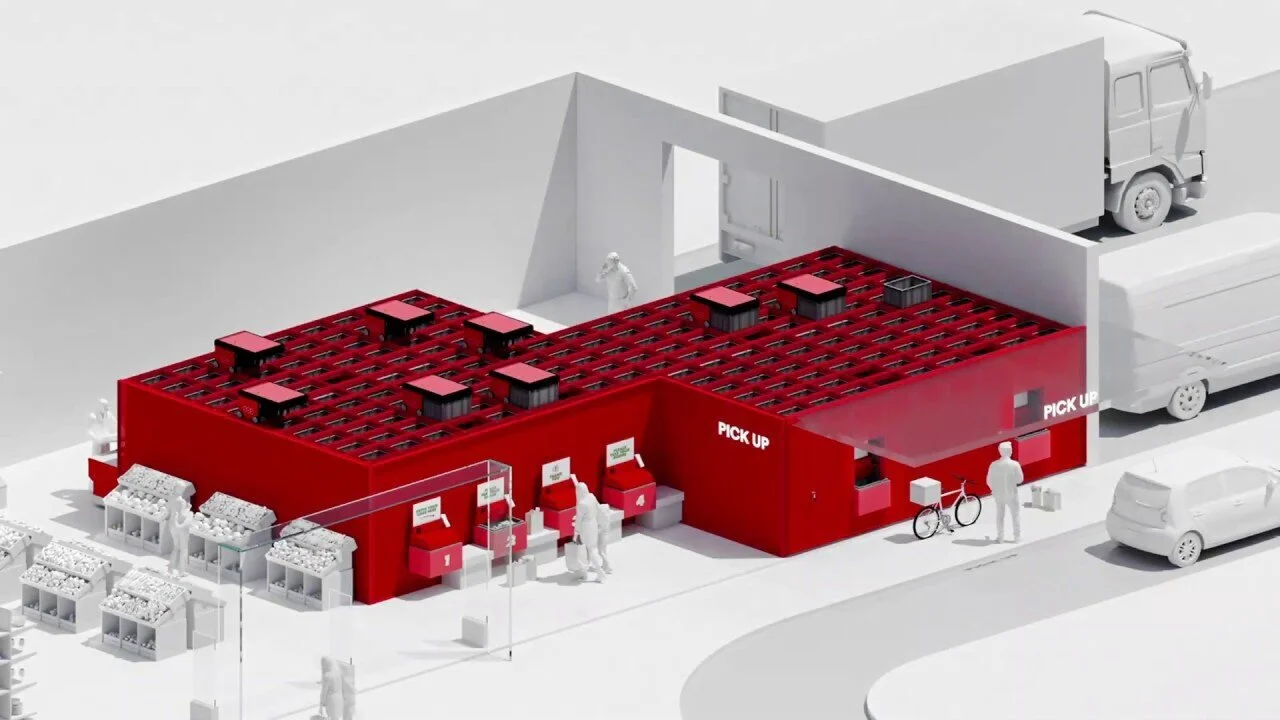

While many retailers are aware of the micro-fulfillment center concept, few have a clear picture of what these small-footprint automation technology solutions look like, or what their full capabilities are. Micro-fulfillment strategies for the future of omnichannel retail, will be the drivers of MFC adoption. Here we explore the leading solution options.

Today, most consumers are located within urban (and suburban) population centers where there is limited available warehouse space. Brick-and-mortar stores already provide broad network coverage of these areas, allowing ample opportunities for retailers to implement micro-fulfillment center strategies within these stores — either to support in-store, e-fulfillment or even convert select stores into dedicated fulfillment centers (aka dark stores). MFC strategies don’t replace traditional distribution center (DC) hubs, but enable distributed fulfillment agility within existing networks.

Implemented successfully, micro-fulfillment is a strategy that can help your company achieve its brand goals, satisfy promises to the customer, and elevate its capabilities. However, micro-fulfillment involves more than simply adding a few urban warehouses to your list of assets. Implementing micro-fulfillment strategies without understanding the holistic needs of the business will generate little value.

Micro-fulfillment should not be a solution that you shoehorn into your operations, but a competitive advantage built from your network strategy. The ultimate question is this: How can a business invest in micro-fulfillment profitably and strategically in a way that keeps their best customers coming back and growing their demand to justify the investments?

To ensure a micro-fulfillment strategy is profitable, companies must work through all the effects it may have on their business—from real estate investments to storefront utilization.

“Adding micro-fulfillment centers in urban areas may impact the role of your larger regional distribution centers”

Brand Strategy

When considering micro-fulfillment, start at the highest level. What is your brand strategy? And what do you want to offer customers? For example, when you look at your brand promise, a set of options emerge with respect to availability, delivery speed and offerings—this should inform whether micro-fulfillment is required. Micro-fulfillment may also be a way to differentiate a brand and create competitive advantage by offering speed and convenience that direct competitors do not currently have. But you will need to first consider whether profit margins allow you to cover or share in the cost of delivery. How much is your customer willing to pay for delivery? How will split shipments impact the cost of shipping or customer impressions?

Network Strategy

Once you determine what your brand strategy requires, you can look at your network strategy. For example, micro-fulfillment might be a solution for companies looking to add the following capabilities to their business:

• Companies with one or two distribution centers that need next-day capabilities in specific markets.

• Companies looking to appeal to the shifting preferences of their customer base can use micro-fulfillment to add service capabilities such as greater speed to delivery or click-and-collect options.

• Companies with multiple banners looking to consolidate or integrate their inventory in mixing centers for a single, unified offering close to the customer. Where larger retailers have acquired smaller or regional retailers and branded them online under a single umbrella, the inventory in these situations has historically been kept in separate locations. Micro-fulfillment mixing centers could bring product together so retailers can ship multiple products in one order to create a seamless brand experience for customers.

Real Estate Strategy

Real estate in prime markets is often expensive. Companies must consider their approach to real estate in relation to their business goals. Does it make more sense to purchase real estate or to lease? Will you need space temporarily or long term? Will you need to scale during peak seasons? Answers to these questions will factor into your micro-fulfillment strategy and costs. Micro-fulfillment centers must not only meet the margin, brand, and share metrics, but also conform to the real estate financials to support the strategy.

Micro-fulfilment centers operate on a much smaller footprint than traditional distribution centers. This opens up a variety of non-conventional warehouse space options, not usually available for industrial tenants. Lower clear height, fewer dock doors, floor conditions and quality are examples of relaxed constraints that give companies the ability to consider a wide variety of options for in-market location and site selection.

Companies might begin by considering a few solutions:

• Repurpose underperforming or dark stores already in operation to provide fulfillment capabilities instead of in-store shopping.

• Carve out back room space, with automated solutions designed for density and flexibility.

• Create pop-up distribution centers or shared space to provide inventory for a quick response in the market.

These can be set up in as few as 30 to 60 days to satisfy peak demand and seasonal trends.

Inventory Strategy

If you choose to implement micro-fulfillment, it’s important to consider the implications to inventory placement and nodes to satisfy your brand strategy. What percentage of SKUs must be maintained in forward nodes? Do these SKUs generate year-round or seasonal demand? Is the demand the same for all markets or best executed in a handful of key metro areas? What percentage of orders can be completed with the inventory in your micro-fulfillment operation? How will you handle those that cannot? Are you able to decrease store inventory and use the micro-fulfillment solution to rapidly replenish store shelves?

Companies should place the most productive inventory in forward locations—usually the top 20% of your SKUs drive 80% of the business. In this way, customers can receive the products they want most often, faster. It’s also important to consider how quickly and by what means customers want to receive this top inventory: Do they want it within days, or hours? Do they want to pick up the product, or have it delivered?

Additionally, the handling, velocity, margin, and dimensions of products have a significant impact on the micro-fulfillment solution you choose. A wide range of equipment, processes and system options exists to satisfy business requirements and these parameters.

Impact on current distribution centers and storefronts

Adding micro-fulfillment centers in urban areas may impact the role of your larger regional distribution centers. Traditional distribution centers may need to take on a larger role in handling eCommerce for slower moving items. Storefronts, on the other hand, may transform into warehouses where the front acts as a showroom while the back of the store acts as an order fulfillment center.

When considered all together, brand, network, real estate, and inventory strategies will impact your unique micro-fulfillment strategy. Ultimately, however, each micro-fulfillment capability should be tied to a specific goal and objective. The goals will drive a very deliberate set of choices for brand, value, service, and competitive positioning that will need to be supported with process, assets, resource, and systems.

Factors such as real estate costs, traffic, labor cost and availability, store density, population density, and more all contribute to if (and what) micro-fulfillment solutions make sense for your company. The goal is to find the right balance of cost and convenience.

Aligning technologies with fulfillment requirements

A defining characteristic of MFCs is their relatively small footprint, which is generally less than 20,000 sq. ft. Automated storage and retrieval systems (AS/RS) and robotics are essential technologies used in MFC automation, which combine to facilitate goods-to-person (GTP) order fulfillment processes. Typical MFC solutions offer storage options from 8,000 to 15,000 SKUs, so SKU density and available installation space are key considerations for selecting the best MFC option for your operation.

Let’s look at two leading micro-fulfillment options:

AS/RS-based shuttle with goods-to-person — utilizes proven AS/RS shuttle systems, but on a much smaller scale (less than 20,000 sq. ft.). Capabilities include:

10,000 SKUs stored in core storage, shuttle AS/RS

2 aisles for ambient SKUs, 1 aisle for chilled/fresh SKUs

Up to 1,000 orders per day based upon 15 lines per order and 2 shifts of operation

Up to 350 tote presentations per hour via high-throughput GTP workstations

Can include stand-alone freezer and storage bays for fast-moving items

AMR-assisted (automated mobile robot) manual picking for fast-movers, frozen goods and store picks

AS/RS-based, high-density storage — combines the best of robotics and AS/RS technologies in flexible, cube-like storage structures.

Increases SKU density by up to 50% over shuttle-based solutions

Modular design is flexible to various building shapes/sizes and highly scalable for future expansion

Increased storage capacity enables opportunistic picking, staging of orders and improved labor balancing

Integrated GTP stations with up to 300 tote presentations per hour per GTP station

Conveyor-less solution results in lowest CapEx and total cost of ownership

To limit the reliance on manual labor and improve productivity and accuracy, either of these options can be further equipped with advanced robotics. Instead of using labor for order picking and consolidation, item-picking robots can be used to create goods-to-robot (GTR) stations. AMRs can be leveraged for transport or assisted picking to further improve productivity, while software-driven artificial intelligence (AI) provides continuous process improvement and operational efficiency gains.