The Retailer That's Still Charging Ahead Without E-Commerce

Structurally, UK-based retailer Primark could not be worse positioned for a global pandemic: it has no e-commerce business to buttress lockdown sales in a sector that has been hammered by bankruptcies and restructurings.

But when coronavirus restrictions first lifted in England in mid June, queues to shop at the low-cost fashion chain stretched around the block at locations across the country. While other high street retailers struggled to entice shoppers back to their stores, sales at Primark bounced back faster than expected. It’s generated £2 billion ($2.56 billion at current exchange rates) in revenue since it started reopening stores internationally in early May.

Like-for-like store sales since reopening are down 15 percent year-on-year. That’s roughly in line with the performance of major retailers H&M and Zara-owner Inditex, which both benefitted from a substantial jump in online sales over the period.

“Getting customers into brick-and-mortar stores is no mean feat,” Chris Daly, CEO at the Chartered Institute of Marketing wrote in a note. “Primark’s strong sales since reopening in May reflect the remarkable customer loyalty the brand has built up over the years.”

Getting customers into brick-and-mortar stores is no mean feat.

Even before the pandemic, Primark was an outlier in a troubled retail landscape. While competitors struggled to navigate the onslaught of digital disruption that has characterised the market in recent years, the low-cost retailer continued to grow fast. Sales rose 57 percent between 2014 and 2019 as consumers responded to the company’s strong brand and highly competitive price point.

To be sure, Primark has not come out of this period unscathed. It didn’t take a single penny for a near-eight-week period in the spring when all its stores across Europe and the US were shut. In England, which houses 40 percent of its near-400-strong store network, closures dragged on well into mid June. The retailer estimates lockdowns cost the business £2 billion in sales and £650 million in profit. Revenue came in at £5.9 billion for its fiscal year ending September 12, down 24 percent from the previous year, while profit slumped 63 percent year-on-year to £362 million, parent company Associated British Foods, which is majority-owned by the prominent Weston family, reported Tuesday.

But while most of the company’s stores could only open over the summer, its position appeared surprisingly resilient.

Now, a second wave of lockdowns is putting fresh pressure on Primark. Over half of the chain’s retail network is currently closed across the UK and Europe. The company is expecting to lose out on £375 million in sales in the lead up to the crucial and lucrative holiday period.

The retailer said it’s braced for the second wave of lockdowns. “We’ve seen this movie before. We have operational plans to manage the consequences of the closures,” AB Foods CEO and executive director George Garfield Weston told analysts earlier this week.

It begs the question: can Primark’s old-school business model really survive in a post-Covid world?

Certainly the company’s lack of e-commerce is a significant vulnerability right now. With the future of the pandemic still a huge question mark, no one knows when retailers will be able to function without Covid-associated disruptions. It’s difficult to predict how long the second wave of lockdowns will last — and whether more are on the horizon next year.

Moreover, the situation is accelerating the rate at which consumers are switching to buying clothes online. This year, the European fashion industry’s e-commerce penetration rose from 16 percent of total sales in January to 29 percent in August, the equivalent of six years’ growth, according to a new report by BoF and McKinsey & Company. Experts are predicting this shift will continue.

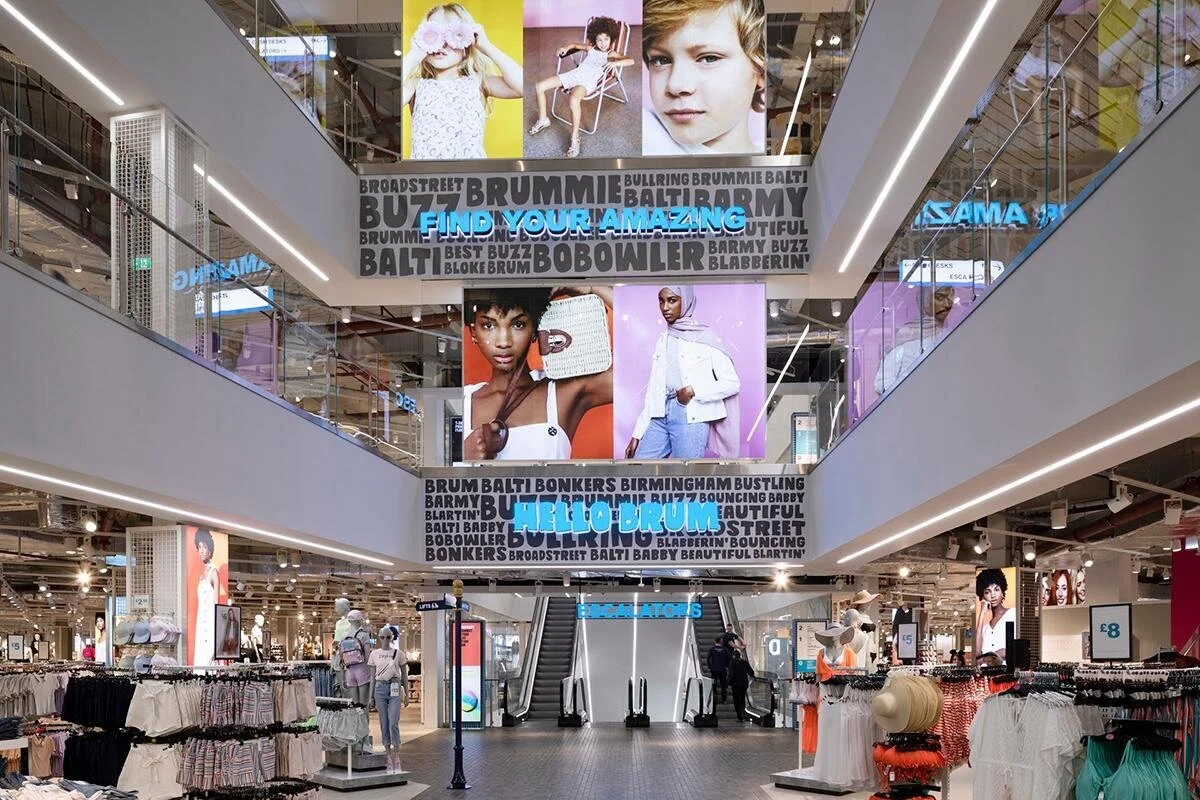

Primark has poured money into upgrading its in-store experience in recent years, an investment that now looks more questionable. Some of its more grandiose outposts (like its Birmingham flagship, which boasts three cafés and a beauty studio offering blow drys and manicures) are located in cosmopolitan city centres, now suffering from diminished commuter footfall and the absence of tourist spending.

High-volume retailers like Primark are also facing additional pressure amid mounting scrutiny of their environmental and social impact. Early on in the pandemic, the chain came under fierce criticism for cancelling all future purchase orders.

On the other hand, consumers also still want low-price fashion. Especially now. While Forrester research shows consumers across age groups and income levels increasingly care about the social and environmental impact of their shopping habits, “when it comes down to it... people may not always be able to afford to act on their values,” said Michelle Beeson, analyst at market research company Forrester. For most, price remains a key deciding factor for a purchase, she said.

At £2.50 for a plain T-shirt and £5 for a pair of pyjamas, Primark offers some of the lowest full-price clothing in the market. And remaining offline is one of the reasons it’s able to keep that price point so competitive.

In a time when disposable incomes are being hit, Primark is a retailer with [the] right price point.

Financially, operating e-commerce alongside a vast store network wouldn’t stack up for Primark. For example, the retailer would have to realign all its distribution centres to pick and package single items, rather than send 200 of them straight to a store.

“[It] is not a straightforward play as they have very low-margin, fast-moving items,” said Beeson. “The economics don’t clearly add up.”

While the pandemic has pushed many purchases online, it’s also polarised the market, similar to the trend seen during the 2008 financial crisis. Luxury shoppers continue to splurge on Louis Vuitton handbags and cashmere sweatsuits, while budget consumers have been pushed further towards frugality.

For many shoppers, Primark delivers exactly what customers need. For an average-income family with three or four kids (who will outgrow any new clothes within months), Primark is a cost-effective way to shop for clothing for the whole family, offering stylish wares at great value.

“Over the longer term, Primark’s low prices should provide a barrier to entry versus online players, which would struggle to match it on price given the pick, pack and dispatch economics of online clothing,” said Richard Chamberlain, managing director of general retail at RBC Capital Markets.

Nearer term, it is the power of the company’s brand that may sustain it. According to market research firm YouGov, Primark is the most famous fashion and clothing brand in the UK with universal name recognition, beating global brands like Nike, Adidas, Levi’s and H&M to the top spot. It ranked 7th most popular fashion brand in the UK, according to data collected between July and October.

“In a time when disposable incomes are being hit, Primark is a retailer with [the] right price point,” said Beeson. “[It] has developed somewhat of a cult following from customers.”

They came flooding back to our stores...the relevance of the appeal of Primark has been more clearly demonstrated through Covid than ever before.

The fact that consumers couldn’t access Primark during lockdowns created “pent-up demand” and helped drive sales when they emerged, said Citibank analyst Adam Cochrane. According to Weston, half of Primark’s core customers bought nothing online during lockdown.

“They waited until we reopened, and then they came flooding back to our stores,” he said. “So we think that the relevance of the appeal of Primark has been more clearly demonstrated through Covid than ever before.”

Despite the current pressures, Primark seems to have no plans to change the way it operates. Instead, it’s pushed ahead with growing its store network in France, Italy and the US, while debuting in Eastern Europe.

It opened 12 new store locations over the last year, including in Florida's Sawgrass Mills mall and New Jersey’s American Dream mega-mall. More US stores are planned for the coming year.

And, it still has no plans to enter e-commerce.

“We couldn't do it properly. It's not something the businesses of scale like Primark can snatch at,” Weston said. “When we are open, we trade very, very well, and we trade our way out of the consequences of having our stores closed.”