3 in 5 U.S. Consumers Now Buy Groceries Online; No Changes Expected Post Covid

COVID-19 drove a mass amount of consumers online for their grocery purchases, and many shoppers won’t be changing their shopping habits as the crisis eases, Coresight Research’s fourth annual U.S. Online Grocery Survey 2021: Post-Surge Prospects survey finds.

What’s more, in the past 12 months preceding the survey (conducted April 1), 59% of the 1,652 consumers surveyed had bought groceries online—the highest level recorded by Coresight.

“COVID-19 has amplified the ongoing digital disruption in the grocery industry. The penetration of e-commerce in the grocery space has lagged behind most other retail sectors; however, the pandemic shook up this status quo by fueling a rapid collapse of consumer uptake barriers and a dramatic acceleration in online grocery growth,” the research firm said in its report.

Based on its survey results, Coresight expects most online grocery shoppers will stick with e-commerce post-pandemic: Over one-third of online grocery shoppers said they do not intend to change their online grocery shopping habits once the crisis eases or ends, and more than one-quarter said they plan to buy groceries online more frequently after the crisis subsides.

Online grocery shoppers ages 30 to 44 are the most likely to continue buying groceries online, with almost 63% reporting they expect to continue at the “same” frequency or “more” frequently once the pandemic subsides.

Satisfied Shoppers

Coresight’s survey also found that shoppers who started to buy online due to COVID-19 are happy with the services offered by retailers, such as delivery and collection, availability of delivery slots and product availability. Almost half of the respondents who started to buy online because of the pandemic are “quite satisfied” with e-commerce service, while 30.7% of those are “very satisfied.”

“This indicates that retailers have generally been successful in ensuring high satisfaction levels among first-time online customers, suggesting a higher likelihood of new customer retention whereby they convert into long-term online buyers,” Coresight said in the report.

Of the e-commerce services, delivery is gaining more traction, with more than 56% of respondents who had purchased groceries online in the past 12 months had their orders delivered, while 43% said that they opted for pickup.

“Retailers must continue to focus their resources on delivery despite the increased profile of collection services amid the pandemic,” Coresight said.

Speed is essential when it comes to delivery. About 26% of survey respondents who shopped online in the past 12 months opted for two-hour delivery, while 42.7% opted for a service longer than two hours but still delivered on the same day.

“Grocery retailers—large and small—should seek to meet consumers’ delivery expectations to avoid losing business to competitors that can deliver more quickly,” Coresight said. “Automation of fulfillment processes, along with a reevaluation of last-mile shipping practices will prove beneficial for retailers in meeting consumer demand for faster delivery.”

Fresh Gains

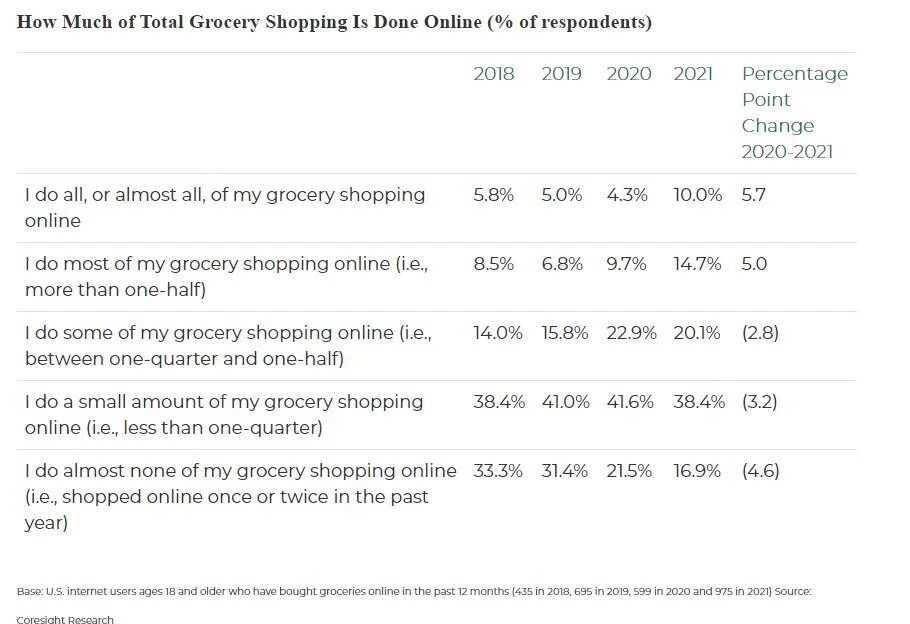

Coresight saw the biggest year-over-year uplift in the proportion of shoppers doing a large amount of their shopping online, with about one-quarter of respondents saying they do “all or almost all” or “most” of their grocery shopping online, vs. 14% last year. This, Coresight said, suggests that the U.S. grocery e-commerce market now accounts for a meaningful share of full-basket grocery shoppers.

And consumers are getting more comfortable purchasing fresh foods online, a sticking point for many shoppers who weren’t always confident in having someone else pick out their fruits a vegetables.

Coresight’s recent survey found gains in online purchases of fresh fruits and vegetables (up 13.4 percentage points), fresh dairy, meat, fish or eggs (up 10.3 percentage points), and baked goods (up 7.8 percentage points).

“The increase across almost all categories indicates that consumers were, on average, buying more categories online as they increasingly adopted e-commerce as a channel for regular grocery shops and not just for ambient and nonfood store goods, although those kinds of products constitute the three most-bought categories,” Coresight said.

Amazon, Walmart’s Tight Race

Amazon and Walmart are the two most shopped online grocery retailers, according to Coresight, and are almost level in their percentage share of online grocery shoppers—but their share is slipping.

The proportion of online grocery shoppers buying on Amazon—the most shopped online grocer—slid by 9.4 percentage points compared to 2020, while No. 2 Walmart’s share declined by 2.6 percentage points.

Meanwhile, other retailers such as Target, Costco and Whole Foods Market saw an increase of online grocery shoppers, which Coresight said suggests these other retailers have “stepped up their efforts to serve customers online and build out omnichannel models to deliver groceries.”