2025 Warehouse Automation: Trends and Key Insights

2025 Automation Survey: Exploring Warehouse Automation Trends

Today, nearly every warehouse or distribution center (DC) has integrated some level of technology or automation into its operations. While some facilities lead the way in adopting advanced automation, others are just beginning their journey. The overarching trend is clear: technology and automation are becoming essential in modern warehouse and DC environments.

Persistent labor shortages, surging e-commerce, and ever-increasing customer demands—especially for faster delivery—are driving the adoption of automation, robotics, artificial intelligence (AI), and other innovations. Companies can no longer rely solely on hiring additional staff to handle peak seasons. Instead, they’re searching for modern solutions to streamline the flow of goods from receiving to storage, picking, packing, and shipping.

To delve deeper into how warehouses and DCs are investing in automation, Peerless Research Group and Modern Materials Handling conducted the “2025 Automation Solutions Study.” This annual survey highlights key factors businesses consider when evaluating automation, current levels of automation adoption, and areas targeted for improvement over the next two years.

The study also examined respondents' order fulfillment activities, improvement plans, projected spending on materials handling solutions in 2025, and preferred sources for fulfillment solutions and replacement parts.

A Shifting Warehouse Landscape

The “2025 Automation Solutions Study” was conducted via email with 139 participants involved in materials handling solutions. Respondents represent diverse industries, including food, beverage, and tobacco (14%); industrial machinery (10%); computers and electronics (9%); and chemicals and pharmaceuticals (8%).

• Respondent Profiles:

35% work in warehouses or DCs,

25% in manufacturing,

19% at corporate headquarters,

17% in warehouses supporting manufacturing.

• Facility Sizes:

30% operate in facilities over 250,000 square feet,

28% work in spaces under 50,000 square feet,

The average facility size is 137,054 square feet.

• Workforce and Revenue:

52% of respondents have fewer than 100 employees,

31% employ between 100 and 499,

Annual revenues range from under $10 million (29%) to over $5 billion (7%), with an average of $765 million—down from $856 million in 2023.

The Automation Movement

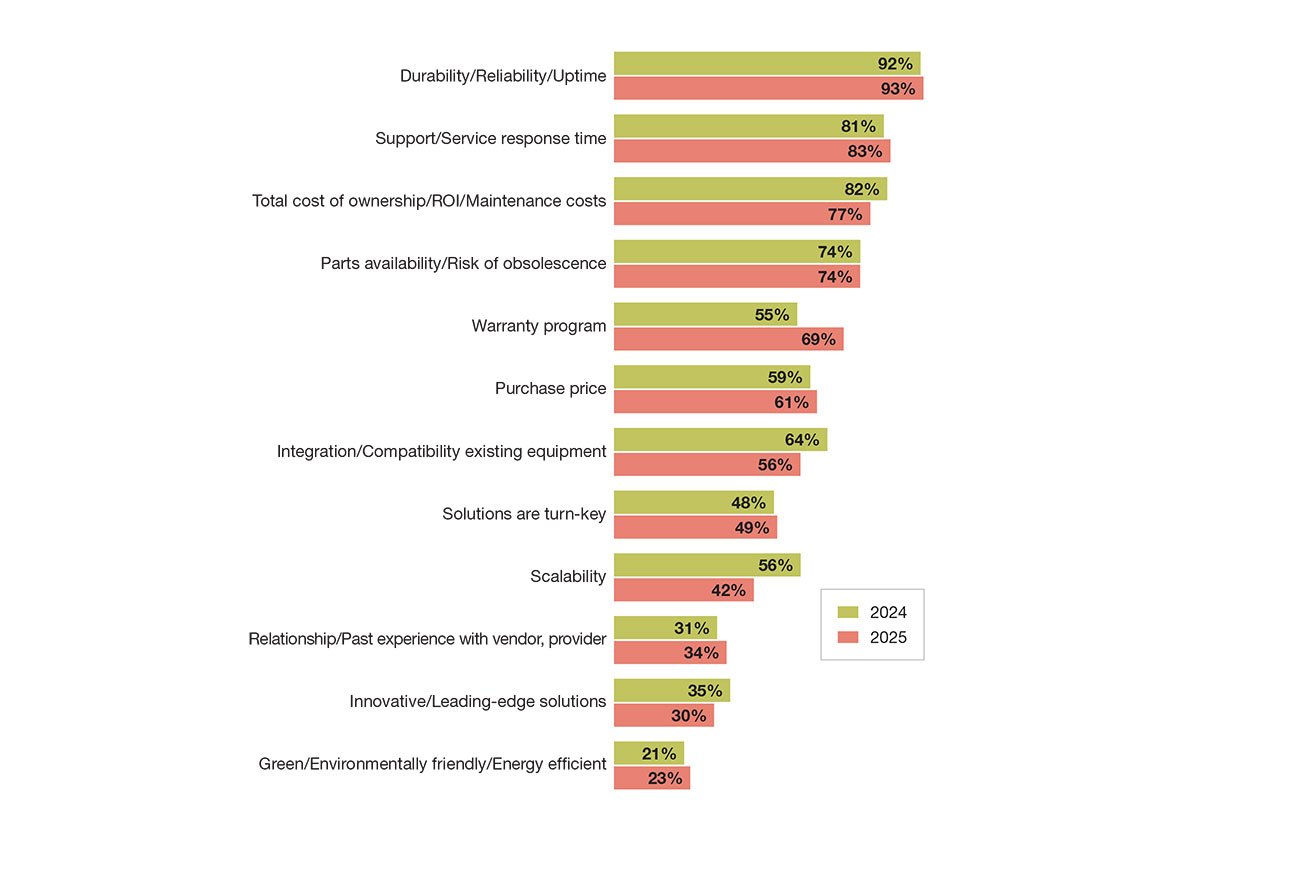

When selecting automation systems, 93% of respondents prioritize durability, reliability, and uptime. Other critical factors include:

Support and service response time (83%),

Total cost of ownership, ROI, and maintenance costs,

Integration with existing equipment (56%, down from 64% in 2023).

Businesses are investing in automation to improve order fulfillment speed, meet service level agreements, and enhance e-commerce operations. Labor constraints also remain a significant challenge, prompting many companies to test new strategies and stay competitive.

Automation’s presence in warehouses is increasing, though many processes remain manual:

• Automated Processes:

15% of companies have fully automated reporting (down from 19%),

10% have fully automated labeling (down from 17%),

9% have fully automated conveyance (down from 26%).

• Manual Operations:

39% of storage functions remain primarily manual, with no immediate plans for automation,

33% of packaging and picking processes are manual but may be automated in the future.

Regarding future plans, 10% of respondents intend to adjust their automation strategies (down from 16% last year). Of this group, 35% plan changes within three months, while 31% expect adjustments within three to six months.

Investment Plans for Materials Handling

In 2025, companies are budgeting an average of $1.5 million for materials handling equipment—a decrease from $1.7 million in 2024. Spending plans include:

36% of companies increasing their budgets,

44% maintaining 2024 levels,

12% planning reduced spending.

Breakdown of spending expectations:

27% will spend less than $100,000,

21% anticipate budgets of $500,000 to $999,999,

20% plan between $100,000 and $499,999.

Modernizing Fulfillment Operations

Companies are focused on managing and improving various fulfillment activities:

Current Operations: 64% manage warehousing and storage, individual pick-pack-ship wholesale fulfillment, and mixed pallet load fulfillment.

Future Plans: 42% aim to upgrade or implement hoists, cranes, and monorails, while 31% plan to enhance palletizers and dock equipment.

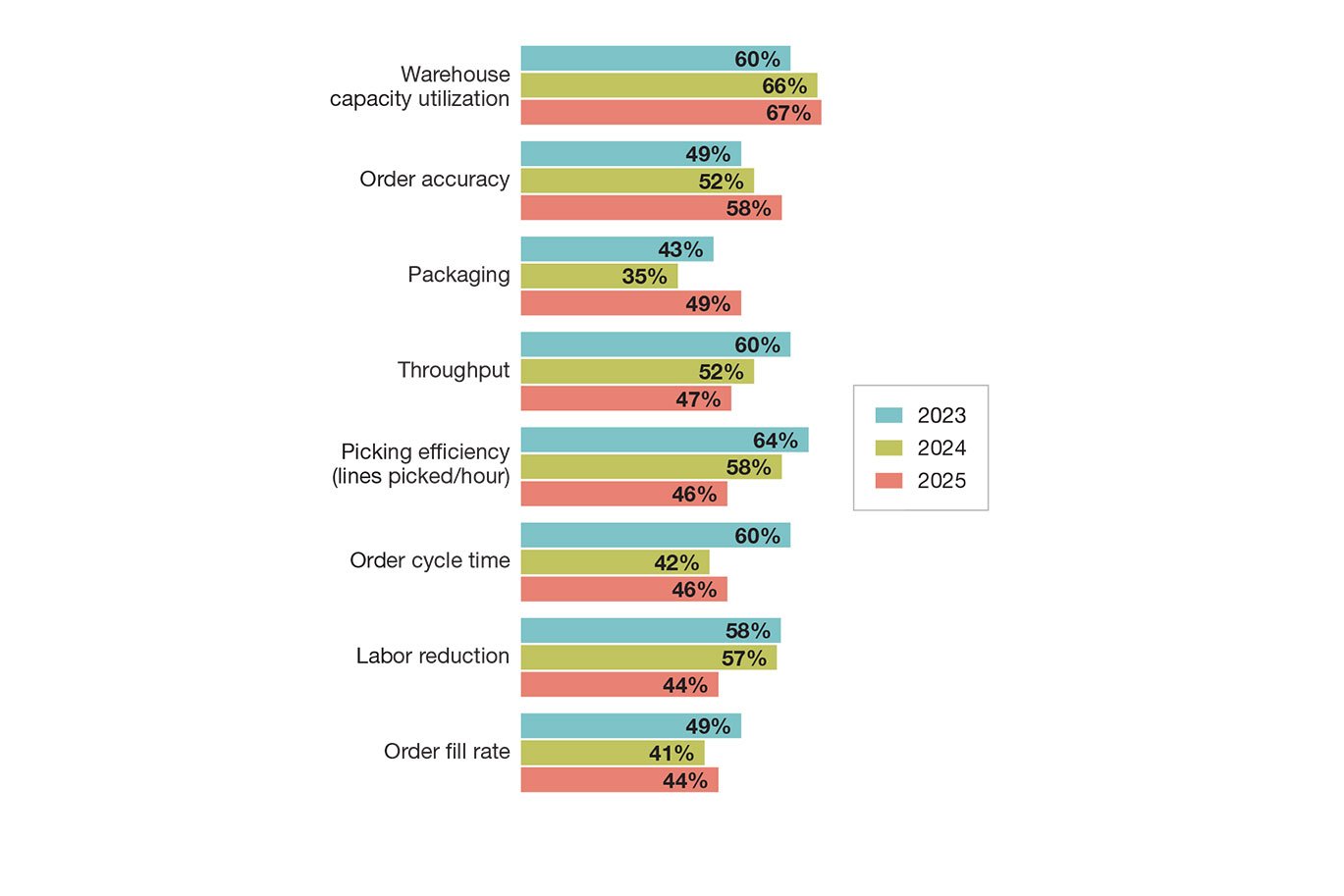

Over the next two years, key goals include:

Better warehouse capacity utilization (67%),

Improved order accuracy (58%),

Enhanced packaging operations (49%),

Labor reduction (44%).

While automation can help achieve these goals, only 4% of respondents describe their fulfillment processes as “highly automated,” compared to 10% last year. Most operations remain either manual (52%) or partially automated (42%).

Key Automation Trends

Adoption of specific technologies remains strong:

Conveyor and sortation systems: 60% currently in use, 40% planning upgrades.

Weighing, cubing, and dimensioning equipment: 56% currently in use, 44% planning adoption.

Robotic Systems: Usage includes:

Palletizing robots (33%),

Pocket sortation robots (32%),

AGVs and AMRs (31%).

The Role of Data, Analytics, and Software

Data collection and software are integral to warehouse operations:

Technologies: 77% use mobile/wireless systems, 76% rely on barcode scanners, and 46% use pick-to-light solutions.

Software: 63% use warehouse management systems, 62% rely on transportation management systems, and 50% utilize warehouse control systems.

Future plans include increased adoption of network design, supply chain planning, and distributed order management software.

The Path Forward

As warehouses and DCs continue to modernize, automation and technology adoption will remain at the forefront. The survey results underscore the critical role of innovation in addressing operational challenges and achieving efficiency goals.