Morrisons to Phase Out Ocado Robots in Favour of In-Store Fulfillment

UK Supermarket company, Morrisons, is making a strategic shift in its online grocery operations, gradually reducing reliance on Ocado’s robotic customer fulfilment centre (CFC) in Erith while expanding its in-store pick model and boosting volumes at Ocado’s Dordon facility. This move reflects Morrisons’ evolving approach to online order fulfillment, emphasizing greater flexibility and the integration of its signature Market Street offer into the online shopping experience. While maintaining its partnership with Ocado and utilizing its in-store fulfillment technology, the change provides Ocado Retail with additional capacity to support its joint venture with M&S, highlighting a growing trend in the grocery sector toward balancing automation with in-store efficiency.

As reported by George Nott at TheGrocery.com (November 28, 2024)

Morrisons is phasing out deliveries of online orders from Ocado’s Erith CFC, and expanding its store-pick fulfilment model.

The supermarket has been working with Ocado since 2013, sharing capacity with the online pureplayer at two of its customer fulfilment centres in Dordon and Erith.

As part of the move, Morrisons will “gradually cease deliveries” from the Erith site, while expanding the number of stores from which online orders are picked from shelves, as well as boosting volumes from Ocado’s Dordon CFC.

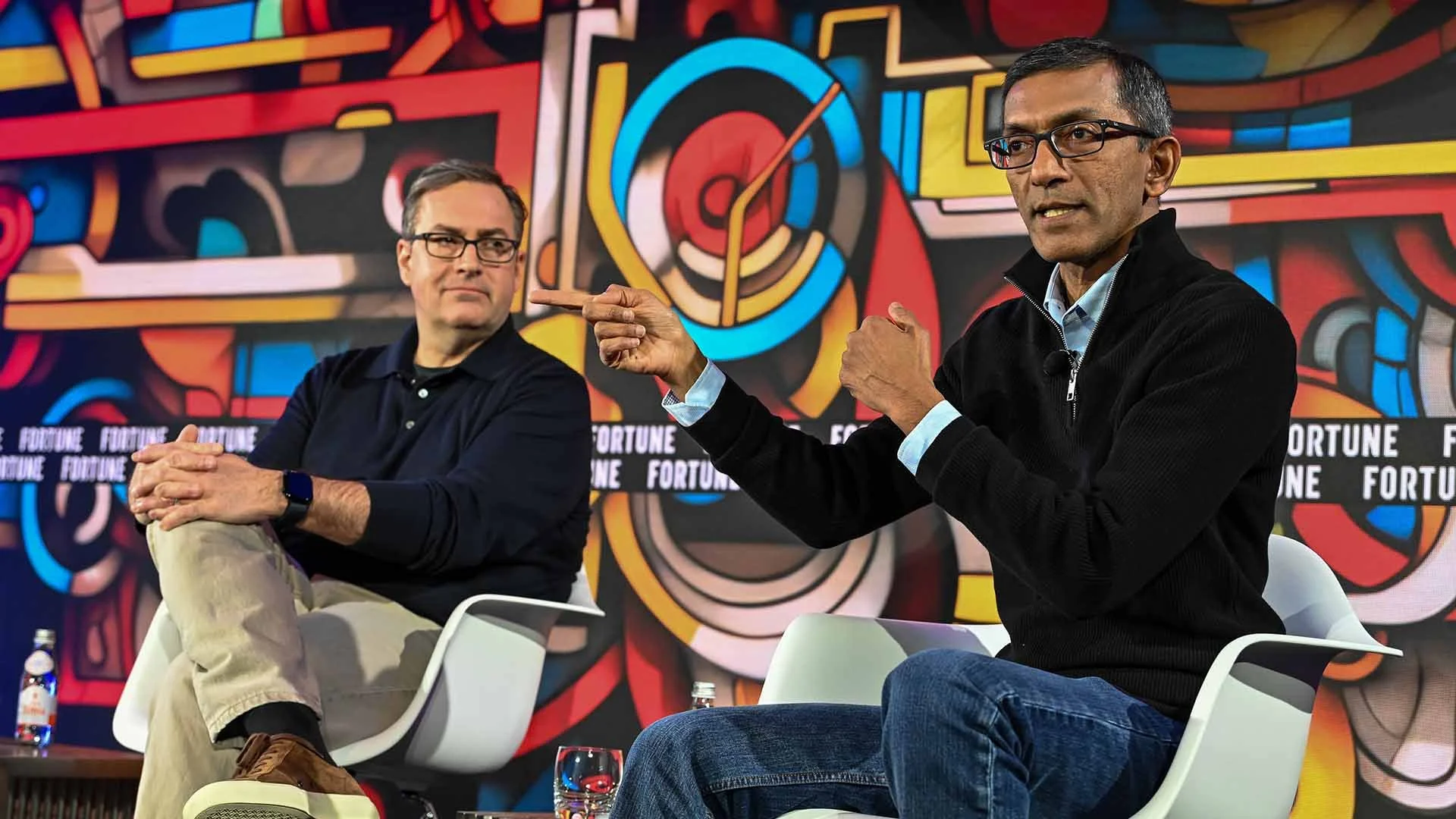

“We have a successful partnership with Ocado and we value their expertise and their technology highly,” said Morrisons CEO Rami Baitiéh. “As our online business continues to grow, we have decided to process a greater share of our online volume through the Dordon CFC and with in-store fulfilment – which gives our customers full access to our unique Market Street offer.

“Morrisons.com will continue to service every postcode in England, Wales and Scotland, with no impact to customers,” he added.

Morrisons will continue to use Ocado’s AI-powered in-store fulfilment solution as part of the picking process.

Ocado said the shift “opens an attractive option” to provide Ocado Retail – the joint venture with M&S – with “extra network capacity over the near term” since it “continues to grow robustly and approaches full capacity in its current network”.

“As Ocado Retail moves towards full utilisation of existing capacity, this decision enables a helpful option to provide it with further short-term growth, without an expectation for additional capex,” said Tim Steiner, CEO of Ocado Group. “As Morrisons reduce their operations at Erith and build their volumes in other parts of the network, we are working with them to ensure seamless continuity of service to their customers and to continue strong market share growth across the UK market with the Ocado Smart Platform.”

Ocado Group said it expected the net cash impact of the move “to be broadly neutral” across the next two financial years.

Last year, Ocado client, the US supermarket chain Kroger put its plans for opening new Ocado-powered CFCs on hold. “Right now, all the energy is focused on the ones we have and making sure that those are where we want them to be, where they need to be and on a sustainable basis…We’re making progress, but we wouldn’t be [at] the point where we would start focusing on additional sheds until we make sure that we have a clear path on the ones we have,” said Kroger CEO Rodney McMullen at the time.

Earlier this year, Canadian chain Sobeys similarly put on pause a plan for another Ocado robotic warehouse and revealed the tie-up between the two businesses was no longer exclusive.

However, in July, deliveries commenced from two new Ocado CFCs for Australian supermarket Coles.

Of Morrisons’ move, AJ Bell investment analyst Dan Coatsworth said it was ”as big of a red flag as you can get for Ocado’s business model”.

“The ground beneath Ocado’s feet continues to crumble,” Coatsworth said. “Ocado’s strategy is centred on the use of automated robots in big warehouses. It believes these are far more efficient than sending grocery workers up and down supermarket aisles with a shopping list, filling a basket.

“Many supermarkets would argue otherwise, particularly because so many people still prefer to do their weekly shop in person and online demand isn’t growing as fast as one might have expected four years ago. The goods are already on the shelves in the supermarket and it doesn’t take long to fill a basket.”

Morrison's rejig to Ocado contract a 'red flag' for online grocery group - analysts

The decision by Morrison Supermarkets to reduce its use of Ocado Group PLC's (LSE:OCDO) robot-run warehouses is another example of grocery chains around the world scaling back expansion plans with the online delivery specialist, according to analysts at AJ Bell.

“The ground beneath Ocado’s feet continues to crumble," they said, following decisions by several clients in the US and Canada.

Morrisons currently shares two 'customer fulfilment centres' (CFCs) with Marks & Spencer/Ocado joint venture, but it now plans to only use one of the sites, Dordon.

Analysts at Peel Hunt said Morissons is not just dropping the Erith CFC but also looking to expand its in-store picking network for online deliveries, which also uses Ocado's fulfilment solution.

They said they expected the continued robust growth of the Ocado Retail joint venture "provides more capacity to meet this growing demand without the need for more capex".

But the AJ Bell analysts said Morrisons relying more on in-store fulfilment is "as big of a red flag as you can get for Ocado’s business model".

While Ocado’s believes its big warehouses are far more efficient than sending grocery workers to fill a basket down supermarket aisles, the AJ Bell team said many supermarkets seem to be arguing otherwise, particularly as so many people still prefer to do their weekly shop in person.

"The goods are already on the shelves in the supermarket and it doesn’t take long to fill a basket. It’s expensive to run a warehouse, get the goods in the van and deliver them to someone’s house," the analysts said.

"While the customer pays a delivery fee, that money is soon gobbled up by the associated costs. One has to consider whether the fee is enough to cover wages, fuel, vehicles and so on. Fundamentally, supermarkets would probably prefer their customers to visit their stores."

Full Story on proactiveinvestors.co.uk >

Related Articles: