The Walmart Formula and Its E-commerce Push

In the past decade or so, retailers have tried with mixed results to build their digital businesses, many eventually in bankruptcy filings citing their difficulties adapting to shifting customer habits.

Meanwhile, Walmart has not only steadily invested in its e-commerce technology, strategically buying businesses including Jet.com, which it has since closed down, and the online brand Bonobos, but it has also pressed on an advantage almost no other retailer has — its vast physical presence.

As one of the world’s largest retailers, Walmart has used its more than 5,300 stores in the U.S. alone, an expanding distribution center network and delivery fleet to branch out from its identity as primarily an “everyday low price” retailer serving a rural and suburban demographic, to develop a competitive online business.

Growing the Walmart+ membership program is a priority that's secondary to providing a great customer experience, and the retailer plans to add new perks as the program grows, CEO Doug McMillon said. "One of the worst things we coul…https://t.co/cijbitfxN8 https://t.co/UVuFNKynxk

— Phil Jeudy (@PhilJ) December 21, 2020

Walmart’s investments in its technology and logistics infrastructure, and its expansion of delivery options and services, have also helped it grow into a viable competitor against Amazon, retail observers said.

“Walmart is also one of the most technologically advanced retailers,” said Jie Zhang, professor of marketing at the Robert H. Smith School of Business at the University of Maryland.

“So it really has perfected the game of supply chain management logistical efficiency,” she said. “And they have a tremendous presence in the physical world — they have a huge number of stores around the country.”

Most of Walmart’s U.S. stores are “Supercenters” — a format that houses a regular-sized Walmart general merchandise store along with a supermarket under one roof. And the company often touts the statistic that 90 percent of Americans live within 10 miles from one of its stores.

Doesn’t fit? No worries! Now customers can return smaller items sold and shipped from https://t.co/vNCVmfWzVb without leaving the house with Carrier Pickup by @FedEx. Select the item, arrange a pickup time and pack it up – all without waiting in line. https://t.co/6mVHz8MTjM pic.twitter.com/BaIw7xa05t

— Walmart Inc. (@WalmartInc) December 21, 2020

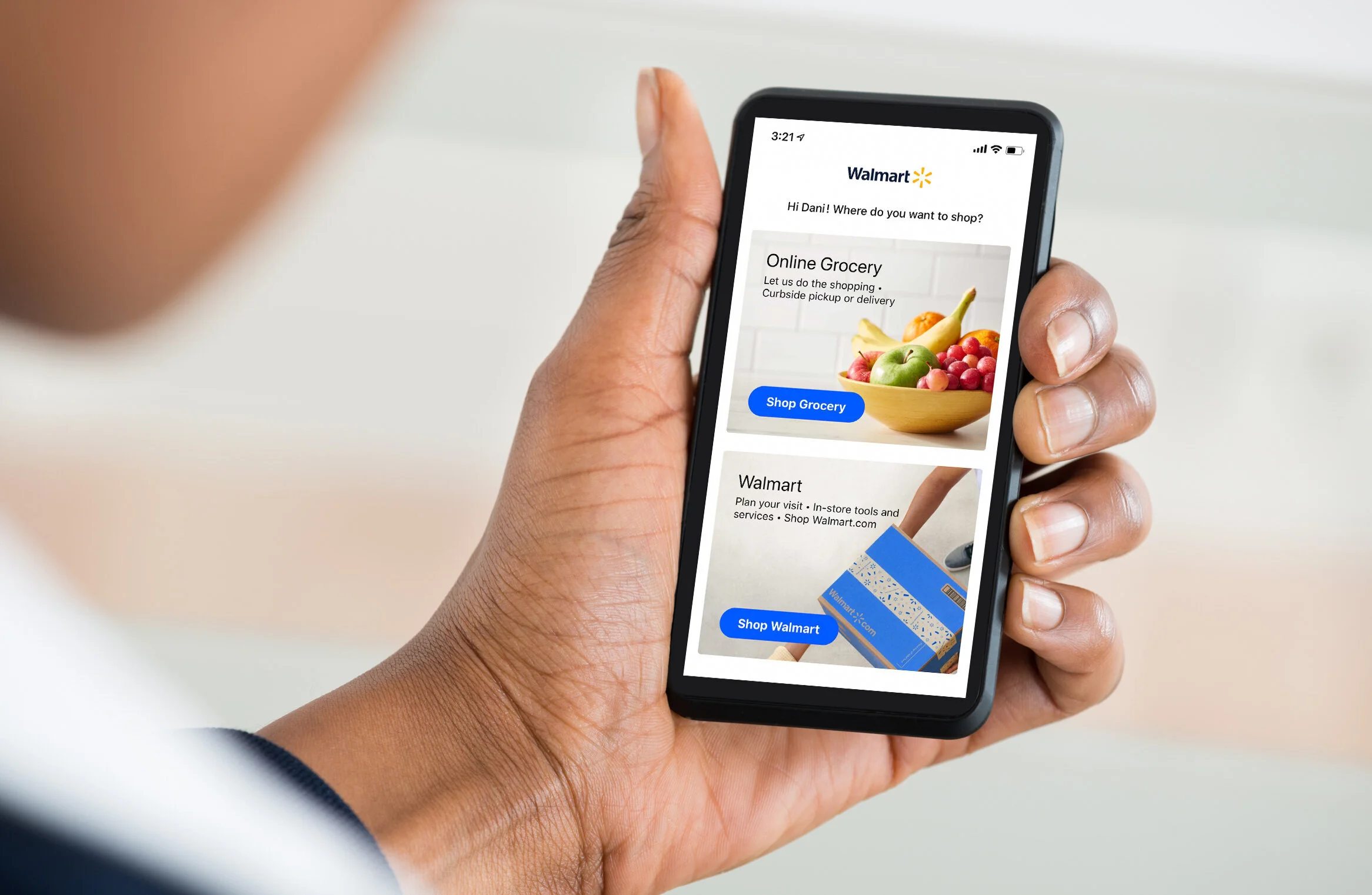

With its e-commerce push and expansion of customer services, the retailer has also courted a younger, more tech savvy shopper with more disposable income, its chief executive officer Doug McMillon said at the Morgan Stanley virtual retail conference this month.

The retailer’s expanded delivery and pick-up options this year, for instance, have drawn newer consumers, he said.

“I think that the more affluent customers, certainly people that are really focused on time, are taking advantage of some of these newer things that we’re doing,” McMillon said at the conference. “And that’s going to enable us to continue to expand in terms of new customers, along with just our pure e-commerce business.”

During the pandemic, Walmart has consistently reported soaring increases in its e-commerce business. In the third quarter alone, the retailer reported that its online business grew 79 percent, a growth executives told analysts had helped the retailer “significantly” reduce its e-commerce operating losses.

Analysts, meanwhile, predict the retailer may now also be recouping its investments in technology to develop its online business.

“A lot of these technology investments work best for scale players,” said Kelly Bania, an analyst at BMO Capital Markets.

“And so, our theory is that they’ve been investing, really, for the past several years, and are starting to kind of turn the corner on making some of those investments pay off,” she said.

“They’ve talked about it in the past couple of quarters, in terms of their e-commerce losses stabilizing and starting to improve a little bit,” she said.

At this point Walmart has more than 150 distribution centers, a transportation fleet of “6,100 tractors, 61,000 trailers and more than 7,800 drivers,” according to its web site. The distribution center network keeps store shelves stocked — and also supports deliveries to customers, according to the retailer.

Walmart and TikTok announced they will be partnering on the first pilot test of a new shoppable product experience on TikTok’s social video app https://t.co/d5KS0Pnq4p via @sarahintampa|@techcrunch #ecommerce #mcommerce #retailtrends #retail #retailtech

— Paul Miller (@paulmiller99) December 21, 2020

That infrastructure has come through as the company dealt with shoppers’ e-commerce demand during the pandemic, Bania said.

“And obviously, [Walmart] has had explosive [e-commerce] growth, like many others this year, really kind of pulling forward some of that volume that you maybe thought was going to happen over the next three to five years,” she said. “That’s been pulled in and that’s really good for them because they’ve built this fulfillment center network.”

One of the reasons the retailer has been able to leverage its physical network to support its online business is its dominance in the grocery sector. Walmart is able to fulfill its fresh grocery orders from individual stores, and, though it’s not only a food retailer, it’s still been the largest grocery retailer in the U.S. for the last two decades, which has also given it access to a vast consumer base for essential purchases.

For instance, groceries now underpin some of the retailer’s new offerings. A survey report that BMO Capital Markets issued in November showed groceries to be the main product category sought by members of Walmart+, the $98 a year membership delivery service that the retailer launched in September as it competes with Amazon Prime.

In response to surges in #ecommerce, @Walmart is implementing a pioneering strategy to better support both online and in-person sales. Read about the retail giant's plan to improve customer service and meet new demand on LoopNet. https://t.co/uA5l8GA96C

— LoopNet (@LoopNet) December 21, 2020

The large number of stores selling groceries primarily through the Walmart Supercenter format have allowed the retailer to catch up in the fresh grocery online shopping and home delivery domain, experts said.

“I think what Walmart realizes with their e-commerce business and their existing business is that they’re the leader in the grocery industry in terms of market share,” Bania said.

“And they, I think, will be pressing on that advantage by using their stores for same-day fulfillment,” she said. “And that’s really led by grocery, fresh and frozen, but also the rest of the store, the discretionary part of the store, and that’s really that same-day offering.”

As many traditional retailers look to significantly expand their digital offerings, especially after a pandemic that has required people to stay indoors and accelerated the demand for online ordering options, it’s worth remembering why this has been a challenging brief for many traditional retailers, experts said.

The way that many retailers in the U.S. have tried to pivot to an e-commerce business has been to open their own websites, and then build up their own distribution centers.

In some cases, traditional apparel retailers have been able to look to their existing infrastructure to adapt to an online business. For instance, companies that had catalogue operations, such as apparel retailers including J.C. Penney and Sears, had some advantage on that front, since the backend operations of fulfilling online orders is similar to the fulfillment process of a catalogue business, said Zhang, the University of Maryland professor.

The mechanics of the process involves fielding orders that come in — either through mail order, or telephone, or through an online interface — which then have to go through a fulfillment process, usually handled by employees working in fulfillment centers, to put the orders into boxes, and then ship it.

“So, they, in fact, have been utilizing their existing catalogue infrastructure, and then transitioning it into primarily serving online orders,” she said.

That hasn’t necessarily translated into success for those retailers. Only this month, J.C. Penney’s retail business emerged from its own Chapter 11 proceedings after a sale of its retail operations to its landlords, while Sears has been contending with its own difficulties even since emerging from bankruptcy last year.

One of the ways that a retailer like Amazon, for instance, has distinguished itself in this exercise is also in the shipping component of the process, Zhang observed. Where most retailers tend to use commercial shipping companies like FedEx and UPS and even the U.S. Postal Service, Amazon has built out its own logistics and delivery fleet, even as it continues to work with other shippers, including the USPS.

Walmart has done the same over the past decade or so, building out its fleet of more than 6,000 trucks to capitalize on those efficiencies.

Growing the Walmart+ membership program is a priority that's secondary to providing a great customer experience, and the retailer plans to add new perks as the program grows, CEO Doug McMillon said. "One of the worst things we coul…https://t.co/cijbitfxN8 https://t.co/UVuFNKynxk

— Phil Jeudy (@PhilJ) December 21, 2020

At the Morgan Stanley conference, McMillon described the retailer’s efforts with Walmart+, and its online operations overall, as an interconnected “ecosystem” that integrates its stores and e-commerce business.

Fine-tuning its mix of product categories, improving its shipping efficiency, and continuing to use consumer data to personalize deals and offerings will be part of the equation, he said.

“We will keep an eye on e-commerce as a business, but also remember we’ve got all these other levers where it’s an omnichannel business, we’ve got a lot of variables on the store side,” he said. “So, when we think of how we blend the combination of revenue, expenses, and profitability together, we think of it in a holistic fashion.”

In recent years, Walmart has also been tweaking its foreign investment strategy, investing in online retailer Flipkart in India and its mobile payments company PhonePe, pulling away from the Asda chain in the U.K. and recently announcing plans to drop its Argentina business.

Those moves align with the retailer’s signals to investors in recent years that the company plans to focus on what it sees as high-growth markets, retail observers have noted.

“I mean, the opportunity that we have in India is enormous, contrast that with the opportunity in Argentina,” McMillon said at the Morgan Stanley conference.

“Yeah, it makes sense that we would spread our energy over a place that’s got tremendous upside,” he added. “So, in India, you’ve got this huge population, over time growing income levels.

“Flipkart and PhonePe are really well run with strong leaders, and we’re going to take e-commerce share,” he said.

On Tuesday, the retailer was hit with a civil lawsuit filed by the Justice Department that seeks up to “billions of dollars” in civil penalties over the its network of more than 5,000 pharmacies’ alleged role in the devastating opioid crisis. In the roughly two decades leading up to 2018, almost 450,000 people died from overdoses that involved either prescription or illicit opioids, according to the CDC.

Our pharmacists in New Mexico are beginning to administer the COVID-19 vaccine to health care workers in select Walmart stores and Sam’s Clubs, as chosen by the state’s department of health. Read more on our support of vaccination efforts: https://t.co/E1LcfjaqVs pic.twitter.com/iamxoDLs1q

— Walmart Inc. (@WalmartInc) December 23, 2020

The DOJ’s complaint filed in Delaware targeted Walmart for alleged violations of the Controlled Substances Act, and accused the retailer of not ensuring that the prescriptions it filled were valid. The DOJ claimed that Walmart “unlawfully filled thousands upon thousands of invalid controlled-substance prescriptions,” and that it did not properly report what prosecutors said were “suspicious orders” by its pharmacies.

“As one of the largest pharmacy chains and wholesale drug distributors in the country, Walmart had the responsibility and the means to help prevent the diversion of prescription opioids,” Jeffrey Bossert Clark, acting assistant attorney general of the DOJ’s civil division, said in a statement.

“Instead, for years, it did the opposite — filling thousands of invalid prescriptions at its pharmacies and failing to report suspicious orders of opioids and other drugs placed by those pharmacies,” he said. “This unlawful conduct contributed to the epidemic of opioid abuse throughout the United States. Today’s filing represents an important step in the effort to hold Walmart accountable for such conduct.”

In a statement Tuesday, Walmart denied the allegations. “The Justice Department’s investigation is tainted by historical ethics violations, and this lawsuit invents a legal theory that unlawfully forces pharmacists to come between patients and their doctors, and is riddled with factual inaccuracies and cherry-picked documents taken out of context,” the retailer wrote.