More than 50% of Walmart’s fulfillment is automated, twice as much as last year

Walmart’s automation boom means lower delivery costs and better careers, says CFO.

Walmart is betting on automation, AI, and the growth of emerging alternative revenue streams to usher the company into a tech-fueled future.

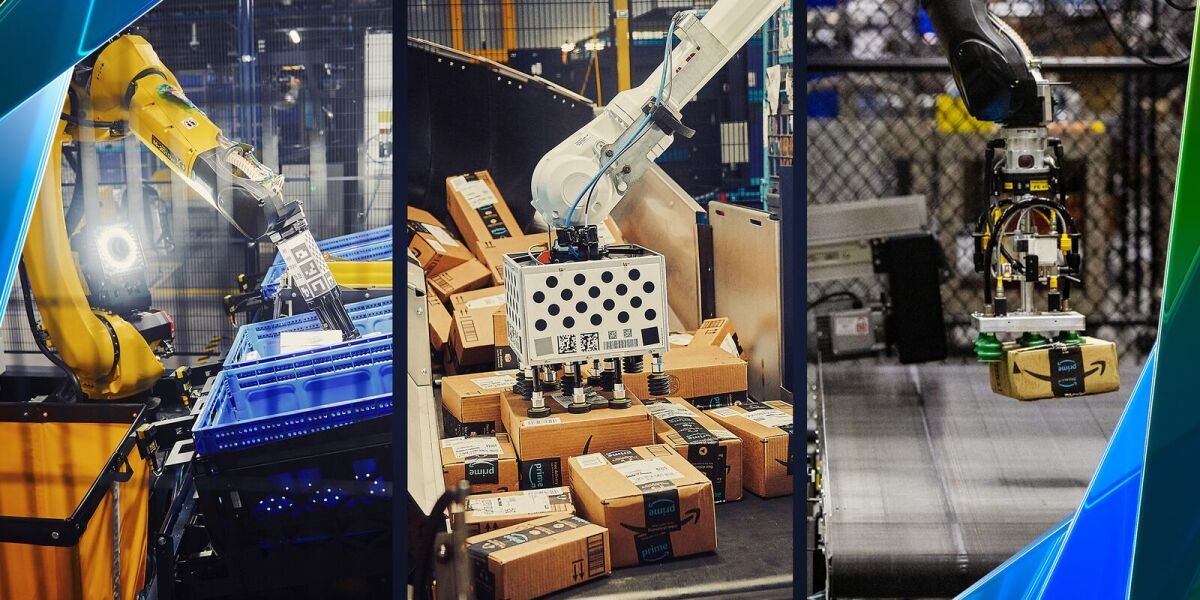

More than 50% of Walmart’s fulfillment center volume is automated, twice as much as this time last year, Walmart CFO John David Rainey said during the company’s fiscal third-quarter earnings call on Tuesday. “This has the obvious benefit of lowering per unit cost of delivery,” he said.

These factors contributed to the third consecutive quarter of approximately 40% reduction in U.S. net delivery costs per order, and customer net promoter scores for delivery reached all-time highs, Rainey said.

Some research points to employees' fear that automation will take jobs. Meanwhile, there’s also research that AI won’t take employees’ jobs if they know how to use it. I asked Rainey on Tuesday about what automation and AI will ultimately mean for workers.

“When we create new ways to serve customers, it often creates new jobs and career pathways for associates,” he said. The technology is allowing Walmart to evolve some of its physically demanding jobs into roles where associates are operating and maintaining high-tech systems, he explained.

“We’re designing new roles, such as automation equipment operator and equipping our associates with the skills to move into these in-demand positions that associates tell us are more enjoyable,” he said.

As part of this process, Walmart is turning its 42 regional distribution centers into high-tech facilities to increase its capacity and speed for sending merchandise to stores while reinventing manual jobs into those that offer new skills in robotics and technology, according to the company.

The retail giant, which ranks No. 1 in the Fortune 500, reported that revenue for the three-month period that ended Oct. 31 increased 5.5% year over year reaching $169.59 billion, beating Wall Street estimates. U.S. same-store sales grew 5.3%, compared with the year prior. Globally, e-commerce was up 27%, and in the U.S. specifically, it grew 22%. Global advertising grew 28% year over year, and membership income was up 22%.

E-commerce now makes up 18% of the business overall. That’s an area where Walmart has been investing and expecting profitability for the long term.

“When you look at the shape of the new income statement,” Walmart CEO Doug McMillon explained on the earnings call, “and you split it between the original income statement that looks like a store P&L and the new income statement that’s got membership, advertising, fulfillment services, data monetization, and maybe some other things in it, it’s more profitable.”

McMillon said the company will grow profit faster than sales, with e-commerce a part of the mix along with other aspects of its omnichannel strategy, which is underpinned by advanced technology.

For example, Walmart has developed a system of proprietary generative AI platforms, such as Wallaby—a series of retail-specific large language models that will primarily be used to create customer-facing experiences. Wallaby is trained with decades of Walmart data.

Walmart’s low prices continue to be a big draw for its customers of all incomes. However, households in the U.S. earning more than $100,000 a year accounted for 75% of Walmart's gains in Q3. The company will work on keeping low prices amid a potential increase in tariffs in 2025, according to Rainey.

Sheryl Estrada - sheryl.estrada@fortune.com