What will the upcoming warehousing and distribution trends be in 2025?

Following on from the predicted trends for 2024 in warehousing and distribution, this piece explores what innovations in this space will be prevalent in the months to come during 2025.

The warehousing and distribution industry is highly capital-intensive, where we project solutions, and innovation takes a long time to see its return on investment. The cycle for the results of specific trends is a long one, but this doesn’t stop new technology and software from being implemented and trialled.

What to expect in 2025 - 7 warehousing trends we will see

Space availability: The warehousing and distribution market next year will be displaying similar trends continuing from 2024 among these is the duality of space availability, tight in certain individual markets, and plenty available in many other areas, where brands and retailers display a wary behaviour on what they are willing to commit to and are perhaps therefore holding less stock (particularly in Asia). This trend, in particular the large-scale availability of space, will most likely extend well into 2025.

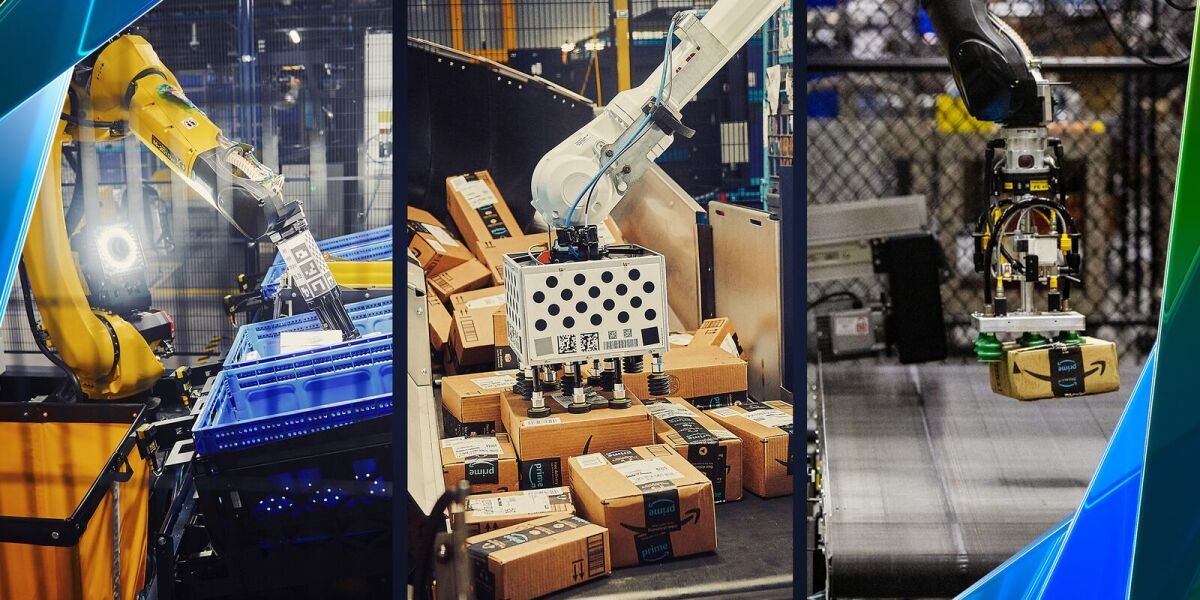

Automation: Just as predicted for this closing year, automation remains a crucial trend for warehousing. A long-term movement that will expand for several years. Considered “a long play” when designing a facility and gradually implementing this technology, its installation and development can be at minimum a 2–3-year project. Regardless, 2025 will see this trend accelerating and increasing particularly when designing new operations or warehouse solutions for companies. Multiple options will be explored, comparing automation to what is considered a “traditional style facility”, considering benefits and possible challenges. Automation will be often chosen for new warehousing and distribution projects, increasing even further the discussion around this in the logistics industry’s “hot topic”. The challenge when implementing automation will remain as cost. The return on investment (ROI) of its implementation requires a payback over a long period (unless it is a very small automation project, such as automating only a selected part of the operation or of the facility). In summary, for standard and bigger projects, the payback will be more than 5 years before being available. Despite this, a move towards automation will still be ongoing in the next year, as a long-term investment, and will be quite transformative through the whole supply chain.

Maintenance costs: Directly correlated to automation, warehousing and distribution providers, and their customers, will be required to take into consideration new maintenance costs, also informally called “the lifetime cost of a project”. These will come with the implementation of new technologies that present different maintenance requirements. Normally, in a standard “traditional” warehouse, shelves and racking are largely present, where all the pallets are placed and stacked. This racking is usually a fixed lump of steel with little to no need for restoration. This investment in steel structures, particularly in the racking structures, has real longevity, lasting more than 20 years, with little to no maintenance needed. On the other hand, new automated equipment that moves the product, like robots or automated forklift trucks, will need more maintenance and require replacement costs, which will be built into the predicted budgeting within a maintenance agreement.

Single stock holding vs. forward-deployed stock: There are several competing arguments as to whether a brand should hold central large amounts of stock or choose forward deployed one. A business should choose a more centralised stock for their warehousing and distribution, essentially a single stock holding points for a larger area and a vast number of channels - where they can serve an omnichannel fulfilment strategy and hold inventory for their e-commerce, their wholesale stock, their retail stock, and so on. The other school of thought is that businesses are moving towards choosing a warehousing and distribution solution based on a forward-deployed stock model, with smaller amounts of inventory, that keeps their products closer to the market they are serving and to where the customers are ordering it from. 2025 will be a year characterised by this choice from companies, and it will be very interesting to see which model is the preferred one.

Connected inventory: Visibility will also continue to have a prime role in 2025. The amount of information a brand will provide to its end-customers will augment beyond parcel-tracking, for more visibility. For logistics providers, the keyword in this space will be “connecting”. For companies with hundreds of different stocking points and just as many lanes of transportation (taking place on ocean, air freight or land) a more connected inventory on a global level will bring a great deal of strategic, high-level visibility on all that is affecting or changing their inventory. “Currently, for many brands, inventory gets moved from one bucket to another, with knowledge only being available to those working in that specific area” says Simon Oxley, Global Head of Business Development at Maersk Contract Logistics, adding that “then maybe that stock gets handed over to the next stage, but quite often it feels like there are a lot of disconnected processes”. 2025 will need therefore to demonstrate a better level of connectivity between processes for an inventory that has shared data and where visibility is clearer at a helicopter level.

Global fulfillment for multiple solutions: For many years, the discussion for many brands when considering warehousing and distribution solutions was focused on single warehousing projects. Isolated to that specific singular need. Logistics providers will then focus on designing, planning, building and organising that specific building and solution. 2025 will be the time when providers and their customers will start looking more and more into building more global relationships and developing multiple solutions for multiple markets, e.g. a solution that can work for South America, Africa, the Middle East, etc. Instead of going into each market separately at different times, 2025 will see more partnerships that can fit different local needs for the same brand (but not without annexed complications).

Towards bigger and better: the size of warehouses will continue to grow. In the last 30 years, the warehousing and distribution industry has been moving towards bigger and better structures, now moving towards more than 100,000 square metre buildings, using better warehouse management systems, faster computer systems, updated inventory control systems that link what is sold in retail stores and what new warehouses can supply through a modern order management systems. 2025 will see even more technological advancement that can support and manage the size of bigger warehouses, providing greater economy of scale, while lowering product’s cost per unit.

How will warehousing evolve?

In summary, powered by technological advancements, space availability, different stock models serving multiple locations across the world, and more, the warehousing and distribution industry is moving in the direction of a more integrated strategy. To be successful in 2025, more businesses will be strengthening their partnerships with integrated logistics providers that can ensure better freedom, flexibility and resilience to easily more cargo across channels and transportation modes.