Canadian Tire Leaving Brampton Transitioning to Automated Fulfillment Hubs

Canadian Tire Corporation, has announced the sale of its 90-acre industrial warehouse property in Brampton, Ontario, for $258 million, following a competitive North American bidding process initiated earlier this year.

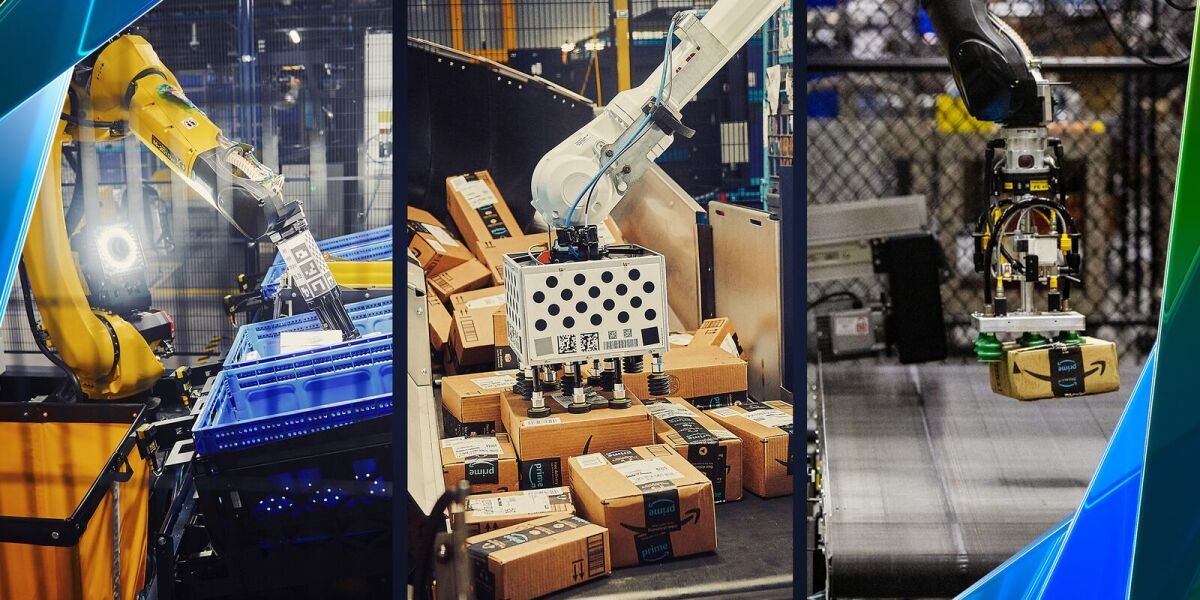

When it first opened, the distribution center was the largest of its kind in Canada and was a leader in implementing leading-edge technologies such as state-of-the-art computerized inventory, high-bay racking systems, and highly complex conveyor and sortation systems for large store orders across Canada.

Located at the intersection of Bramalea Road and Steeles Avenue, the site includes 1.5 million square feet of industrial real estate.

The company says the distribution center is no longer needed and instead will operate out of newer, more modern, more highly automated facilities in the Greater Toronto Area.

It is not known how it will affect jobs at the site or if workers will be transferred to other facilities.

Located at Steeles Avenue and Bramalea Road, the 93-acre site has been a huge presence in Brampton supplying jobs in the community for more than half a century.

Once a pivotal hub for the company’s distribution operations, the property is now deemed surplus due to strategic supply chain investments and facility consolidation over the past several years.

“This site was groundbreaking when it was built 50 years ago and played a crucial role in shaping our supply chain,” said Greg Hicks, President and CEO of Canadian Tire Corporation. “Today, we’re building on that legacy by investing in modern, state-of-the-art facilities in the region, ensuring our supply chain is equipped for the future.”

Hicks emphasized that the sale underscores Canadian Tire’s ability to unlock shareholder value from underutilized assets, aligning with the company’s broader strategy to optimize its real estate portfolio.

The transaction marks another example of Canadian Tire capitalizing on its real estate assets, following recent property sales in Chilliwack, B.C., and other parts of the Greater Toronto Area, as disclosed in its Q2 and Q3 2024 results.

The sale is expected to generate a pre-tax gain of approximately $240 million, which will be recorded as a normalizing item. Proceeds will be directed toward reducing debt tied to the October 2023 repurchase and consolidation of Canadian Tire Financial Services.

The transaction is slated to close in the fourth quarter of 2024, subject to standard closing conditions.